IVORY COAST

Compliant HR, Payroll, Tax & Employer of Record Africa

OVERVIEW

Ivory Coast is a country in West Africa. Through its production of coffee and cocoa, the country was able to sever its ties to France and became independent on the 7th of August 1960. The country is bordered by Ghana, Liberia, Guinea, and Mali.

The Ivory Coast is the world’s largest producer and exporter of cocoa, one of the world’s three largest producer and exporter of cashew nuts, and a major exporter of palm oil, coffee and oil. The country’s economy is mainly based on agriculture. The primary sector contributes more than a fifth of the GDP and employs less than half of the country’s active population. The country’s production of rubber has increased substantially in recent years. The oil sector is gaining importance in the economy, with a steady growth rate and major investments. The country has some mining activities, particularly of precious minerals, such as gold and diamonds, but also others like nickel.

GENERAL INFORMATION

CAPITAL CITY

Yamoussoukro

OFFICIAL LANGUAGE

French

CURRENCY

West African CFA Franc

DIALLING CODE

+225

TAX AUTHORITY

Tax authority: Douanse de Côte d’Ivoire

http://www.douanes.ci/

TAX YEAR

1 January – 31 December

TIME ZONE

UTC+0

GENERAL INFORMATION

CAPITAL CITY

Yamoussoukro

OFFICIAL LANGUAGE

French

CURRENCY

West African CFA Franc

DIALLING CODE

+225

TAX AUTHORITY

Tax authority: Douanse de Côte d’Ivoire

http://www.douanes.ci/

TAX YEAR

1 January – 31 December

TIME ZONE

UTC+0

MORE INFORMATION

As in many other African countries, the tertiary sector has been experiencing rapid growth in the last several years. The telecommunications sector is booming and, together with other sectors, acts as a driver of the growth in services. Services contribute around 45{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1} of the GDP and employ 46{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1} of the work force.

Ivory Coast, also known as Côte d’Ivoire, is one of quickest booming economies in the world. Its economy has grown at an average of 8{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1} per year from 2012 to 2017. The country’s projected GDP growth is expected to reach 7.4{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1} in 2018 and the strong development is likely to continue through 2020 according to the World Bank (World Bank, 2019).

It is currently the chief member of the West African Economic and Monetary Union (WAEMU) and it also aims to be the biggest interchange hub in West Africa as well as the doorway to the Economic Community of West African States (ECOWAS). The government’s National Development Plan (NDP) intentions are to transform Ivory Coast into a middle-income economy by 2020 (World Bank, 2019). Ongoing and planned road, port and railway investments and developments will boost the national and regional trade in the IVC.

Official Holidays:

1 January (New Year’s Day)

22 April (Easter Monday)

01 May (Labour Day)

30 May (Ascension Day)

02 June (Revelation of the Qur’an)

05 June (Korité)

10 June (Whit Monday)

07 August (Independence Day)

12 August (Tabaski)

15 August (Assumption Day)

01 November (All Saints Day)

10 November (Prophets Birthday)

15 November (National Peace Day)

25 December (Christmas Day)

Step 1: Apply for Visa and Work Contract

For Work contract visa:

- Four (4) copies of the non-Ivorian employment contract form to be completed;

- Professional references (diploma, work certificate or work attestation);

- One (1) criminal record;

- One (1) Resume;

- One (1) certificate of medical examination;

Process estimated to take 1 month.

Step 2: Apply for Work Card/Permit (1 Year):

Work card/Permit:

- One (1) application for a work card to complete;

- One (1) true copy of the employment contract signed;

- Two (2) identity photos of the same draw;

- One (1) photocopy of the passport

Process estimated to take 3 months

Step 3: Residence Card

Documents Required for Residence ID:

- Employment contract signed;

- A request card application.

- Physically present for biometric verification

Process estimated to take 2 weeks dependant on availability of personnel ability to attend the appointment at immigration. All documents submitted 2 weeks before appointment.

EXAMPLE COSTINGS IVC IMMIGRATION

Corporate Tax

Taxable corporate income in the Ivory Coast is based on the worldwide income for resident companies. Tax on industrial and commercial profits in the Ivory Coast is levied at 25{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1}, subject to a minimum tax. The rate is 30{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1} for companies in the telecommunication, information technology, and communication sectors.

Non-resident entities are subject to withholding tax (WHT) at 20{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1}, subject to existing double tax treaties (DTTs), on their Ivory Coast source income when they do not have a permanent establishment. Non-residents with a permanent establishment are taxed in the same way as a resident.

Minimum tax

The minimum tax is based on total turnover and is calculated at the rate of 0.5{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1}, with a minimum tax of 3 million CFA (Financial Community of Africa or francs (XOF) and a maximum tax of XOF 35 million.

Personal income tax rates

Resident individuals in the Ivory Coast are subject to precise direct income tax, which is dependent on the type of income earned, and to general income tax (IGR).

1. Salary tax (IS)

1.1 1.5{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1} of 80{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1} of gross income (GI) is levied as IS, which is withheld by employers.

2. National contribution (CN)

2.1. 80{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1} of gross income is taxed as CN at progressive rates from 1.5{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1} to 10{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1}, based on varying tax brackets as shown below.

Formula: CN = (80{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1} x GI x Tax rate) – Variable

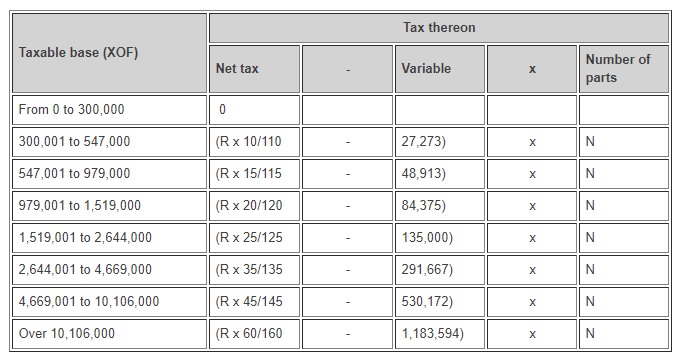

General income tax (IGR)

Formula: IGR = (T/N x (Tax rate) – V) x N, where:

The taxable base (T) for IGR is derived as shown below, and includes a 15{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1} deduction.

T = (GI x 80{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1} – (IS + CN)) x 85{8870c2225e05d1feea6df94638aa7ff56b3555cf8fa8f542e1293bebc40085d1}

GI = Gross income

IS = Tax on salary

CN = National contribution

V = Predetermined variable

N = Number of parts (see Personal allowances in the Deductions section)

In Côte d’Ivoire, the sources of law on termination of employment consist of:

- the Labour Code, Act No. 95-15 of 12 January 1995 (LC),

- the Inter-occupational Collective Agreement of 20 July 1977,

- Act relating to dismissal for economic reasons No. 92-573 of 11 September 1992,

- Decree on contracts of employment No. 96-287 of 3 April 1996,

- Decree on the engagement for a probationary period and duration of probationary periods No. 96-195 of 7 March 1996,

- Decree on the length of the notice period and termination of a contract of employment No. 96-200 of 7 March 1996 and

- Decree on severance allowance No. 96-201 of 7 March 1996.

The Labour Code is applicable throughout the territory of Côte d’Ivoire and governs relations between employers and workers. However, public employees and persons working in public corporations are excluded from its scope (secs. 1 and 2, LC).

Contracts:

A contract of employment may be concluded for a specified or unspecified period (sec. 13.2, LC). The contract of employment may contain a probationary period, the duration of which must be stated in writing.

A probationary period may last (sec. 2, Decree No. 96-195 of 7 Mar. 1996):

- eight days for daily or hourly paid workers;

- one month for monthly paid workers;

- two months for supervisors, technicians and similar workers; or

- three months for engineers, managers, high-level technicians and similar workers.

- These periods may be renewed once. Any renewal must be made in writing and the worker must be informed in advance according to the following schedule (sec. 4, Decree No. 96-195 of 7 Mar. 1996):

- two days before the end of the probationary period of eight days;

- eight days if the probationary period is one month; or

- 15 days if the probationary period is two or three months.

If the worker continues to be employed on the expiry of the engagement for a probationary period or its renewal, the parties are bound by a contract of employment of unspecified duration (sec. 7, Decree No. 96-195 of 7 Mar. 1996).

A contract of employment for a specified period must be made in written form or confirmed by a letter of employment and must indicate either the date on which the contract expires, or the precise duration for which it is concluded, except in the case of contracts concluded in order to replace a worker who is temporarily absent, for a season, for a temporary accumulation of work, or for an activity which is not part of the normal operations of the undertaking (sec. 14.6, LC). This is the case for contracts for a specified duration but with unspecified term, which pertain to contracts for daily workers engaged by the hour or by the day for a short-term job and paid at the end of the day, week or fortnight (sec. 14.7(2), LC).

Fixed-term contracts of employment may be renewed without limitation. However, their total duration cannot exceed two years (sec.14.5, LC).

Paid Leave:

Unless there is a more favourable provision of collective agreements or individual contracts, the worker shall be entitled to leave with pay, at the expense of the employer, at the rate of two working days per month of actual service, except for workers of Under the age of eighteen who are entitled to two days and two tenths.

The annual period of leave defined in the preceding article shall be increased by two working days after fifteen years of seniority in the same undertaking, four days after twenty years, six days after twenty-five years and eight days after thirty years.

Where the contract of employment ends before the employee has been able to take his leave effectively, an indemnity calculated on the basis of the rights to leave acquired on the day of the expiration of the contract shall be paid to him as compensation.

Employer of Record Ivory Coast Africa

Although an Employer of Record often works with a staffing agency, the two are separate business entities. Each has specific roles and responsibilities in their symbiotic relationship. We Handle Employer of Record and Payroll throughout Africa.

Purpose

An employer of record serves as an employer for tax purposes while an employee performs work for the client, such as a staffing firm or other business. An employer of record handles all personnel functions, including payroll processing and funding; tax deposits and filing; and employment contracts and paperwork. Maintaining a Certificate of Insurance, and Verification forms; unemployment insurance; and workers’ compensation are done. An employer of record also performs background checks and drug screenings; administers benefits; terminates employees; and may handle worker issues. Conversely, a staffing firm recruits’ employees and assigns them to businesses for worker absences, temporary skill shortages, seasonal work, or special projects. Their main focus is to match temporary, temp-to-hire, long-term, or permanent workers with clients in need.

Benefits

Using an employer of record allows the client company to free up time and cost-effectively outsource its necessary human resource functions, employee benefits, payroll, workers’ compensation, and compliance issues. The money saved by outsourcing these functions can be used to expand the business, provide steady income for the owner, or fill a variety of other purposes. Onboarding quality talent is done quickly by an employer of record so clients can quickly ramp up staff and staffing agencies can deliver top quality workers to their clients. Most staffing agency owners don’t have the HR training, payroll and accounting skills, compliance knowledge, or risk management, insurance, and employee benefits background to meet the demands of being an employer.

Responsibilities and Liabilities

The client company or staffing agency owner retains control over business operations and responsibility for workplace safety and compliance. The employer of record assumes responsibilities and liabilities for employment issues such as administration, payroll, taxes, benefits, and maintaining employee records. Because the employer of record assumes most of the responsibility for compliance and tax laws, the client or staffing services owner receives peace of mind, knowing their business is being taken care of by qualified professionals.

Whereas an employer of record and staffing agency often work together, they have diverse purposes in the workplace.